While the immediate ripple effects of Brexit in China are palpable, the potential medium- and long-term impact is as uncertain as the ultimate outcome of the decision itself

Chinese students inquire about studying in the UK at the China Education Expo, Beijing, October 24, 2015 / Photo by IC

“While Donald Trump is still a dark horse, Breit has already turned out to

be a black swan,” noted Wu Qing of the Development Research Center (DRC) of China’s State Council, at a July 4 roundtable discussion sponsored by the DRC’s in-house publication, China Economic Times. Drawing on the analogy that equates the dusky aquatic bird with bad news, Wu, along with most international and Chinese analysts, was stunned by the decision of UK voters, albeit by a very narrow margin, to leave the European Union (EU) in a nationwide referendum on June 23.

Chinese consumers responded quickly. “Our package UK tours for the three months

from June are already overbooked, ” Wang Xuetong, a tour guide with a leading Beijingbased travel company, told NewsChina. The devaluation of the British pound before and after Brexit, she believes, further fueled Chinese tourists’ enthusiasm for the UK, generating an uptick in visitor numbers already boosted by the relaxation of its tourist visa policy and extensive Chinese press coverage in the wake of President Xi Jinping’s visit to London last October and the 90th birthday of Queen Elizabeth II. Chinese retail investors, meanwhile, busied themselves with buying and selling gold products and shares in listed gold companies, joining the predictable global gold rush that followed in the wake of the Brexit vote.

International and Chinese economic analysts were less enthused. The UK and the EU, it appears, face a crisis of confidence not only within, but beyond their borders. Wu and

most Chinese analysts generally converged in describing the referendum as a “lose-lose” result for both Britain and the EU, at least in the short-term. They shared concerns with their international counterparts over the prospects for a world economy now overshadowed by the uncertainty of the pending Brexit negotiations between Britain and the EU. Major international financial institutions have adjusted their growth forecasts for Britain and the world economy downward.

For Chinese analysts, their concerns over the impact of Brexit on China included the most immediately apparent change – the value of the Chinese currency – to the short- and medium-term adjustment of investments, as well as to the long-term and broader implications for global geopolitics. Mixed messages abound.

Meanwhile, in London

The first Brexit shockwave hit international financial markets, in which China’s stakes

have been increasing. The British pound has hovered around a 30-year low against the US dollar since the Brexit referendum result was announced, and the euro has also taken a tumble. Panicking investors seeking a safe haven resorted to buying US dollars, Japanese yen and gold. This further fueled strong market expectations of the further devaluation of the Chinese yuan, which is not in the safe haven basket of currencies preferred by international investors. Simultaneously, the inflated value of the yen has been widely cited as one of the reasons for the unexpected increase in China’s official foreign exchange reserves, which include the Japanese currency, in June.

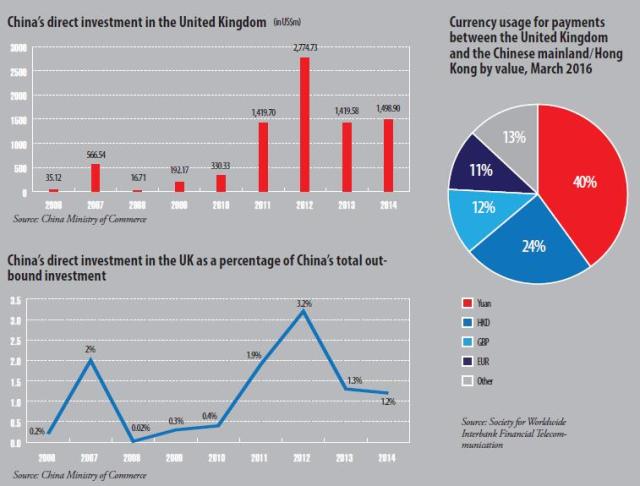

Much less clear but much more important is Brexit’s long-term impact on the internationalization of the Chinese currency. In April, the Society for Worldwide Interbank Financial Telecommunication, the global financial messaging service provider better known as SWIFT, found that, by the end of March, London had overtaken Singapore as the largest offshore yuan clearing center after Hong Kong. On June 8, China’s first sovereign bonds outside Greater China were issued and listed on the London Stock Exchange.

London’s position as the world’s leading financial hub has now been tainted by Brexit. International banking giants are reportedly already downsizing their offices in London, out of fear that the City will lose its European business license. Paris and Frankfurt, also offshore yuan clearing centers, immediately started to compete for the business of financial institutions, enterprises and personnel now looking elsewhere.

There are widespread jitters over further fluctuation of the yuan exchange rate and potential setbacks for the currency’s internationalization due to possibly drastic changes in London and on the international financial markets after Brexit. However, notes of optimism are also being struck. In the same panel discussion featuring Wu Qing, Wan Zhe, chief economist with China National Gold Group Corporation, said that London has established its status as a financial hub on the back of a long history of well-developed financial markets, systems and talent. Brexit, he added, may also free the UK from the EU restrictions on financial transactions, and possibly the negative impact of current interest rate policy on the eurozone, even though the UK has never adopted the single currency. Wan noted that many financial institutions held similar opinions.

“London’s position as an international financial center is not built on its reliance on the European continent; on the contrary, the European continent has benefited a lot from London’s financial services,” Mei Xinyu, of the Chinese Academy of International Trade and Economic Cooperation, a think tank under China’s Ministry of Commerce, wrote in a June 29 article for the 21st Century Business Herald. He does not believe Brexit will have a long-term negative impact on the internationalization of the yuan.

The acquisition of the London-based Odeon & UCI Cinemas Group by AMC Entertainment Holdings, announced on July 12, will create the world’s largest theater operator / Photo by IC

Buy or Wait?

This is no surprise, as the UK’s pro-trade and pro-investment politics, commitment to the rule of law and, previously, EU membership had made it an ideal springboard to the wider EU market for non-EU investors. However, the same factors have led to the drawing of different conclusions by Chinese analysts regarding the prospects for Chinese investment in post-Brexit Britain.

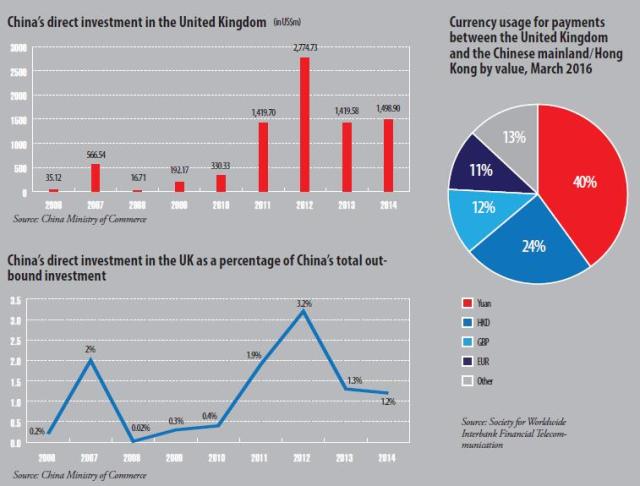

Another hot issue in the mix is the potential for less fluid capital flows for China’s investment in the UK and the EU. China’s outbound direct investment has been increasingly shifting to Europe and the US and away from less-developed regions. The EU market has been regarded as a more open and friendly destination for Chinese capital than the US. If Hong Kong is disregarded due to its unique function as a transit of investment to other destinations, the EU is the favorite destination of Chinese outbound capital. According to New York-based consultancy Rhodium Group, Chinese investment in the EU averaged in excess of 10 billion euros per year from 2011 to 2015, a stark increase from the 1 billion euros recorded in the previous five years. The same data also shows that the UK received more Chinese green field investment and mergers and acquisitions in accumulative value than any other EU member state from 2000-2015.

This is no surprise, as the UK’s pro-trade and pro-investment politics, commitment to the rule of law and, previously, EU membership had made it an ideal springboard to the wider EU market for non-EU investors. However, the same factors have led to the drawing of different conclusions by Chinese analysts regarding the prospects for Chinese investment in post-Brexit Britain.

Mei Xinyu remains confident, predicting a “pendulum” scenario in the years to come, meaning some foreign investors in the UK, including those from China, would depart right after Brexit, but then return to the UK a few years later. He claimed they would find the business environment in the UK to be much better than the EU’s, where politicians still shy away from liberalization of the labor market or cutting red tape at the policymaking level.

In their analysis in Caijing magazine published on July 12, Wang Bijun and Zhang Ming with the Chinese Academy of Social Sciences offered a different view. While agreeing that Chinese investors would enjoy an even more free and open post-Brexit UK market, they stressed that the UK would be less attractive to Chinese investors who value easy access to the EU market previously offered by a UK base. Uncertainty over how the UK might have to rewrite its rules means, they noted, additional policy and legal risks for foreign investors.

Money talks, but in a different language to different investors. On July 12, AMC Theaters, a US movie theater chain acquired by Chinese billionaire Wang Jianlin’s Dalian Wanda Group in 2012, announced a more than US$1 billion (£921m) purchase of the London-based Odeon & UCI Cinemas Group, the largest theater exhibitor in Europe. As the payment will be settled in pounds sterling, currently at a post-Brexit three-decade low against the US dollar, AMC CEO and President Adam Aron described the deal as a “once-in-a-generation opportunity.” The acquisition will make AMC the world’s largest theater exhibitor. While some Chinese real estate investors seek to do the same as Wang Jianlin for other bargain price acquisitions of British assets, others are either shifting their gaze to the US, Canada and Japan, or maintaining a wait-and-see attitude after Brexit, according to a survey released on July 4 by international property service provider Cushman & Wakefield and DTZ.

Workers at Hangzhou Steel, whose plant was recently demolished as part of an anti-pollution drive. Cheap Chinese steel has been a barrier to closer UK-EU-China trade relations, Zhejiang Province, June 15, 2016 / Photo by IC

Chances and Challenges

There is a very vocal faction, particularly prominent in the international media, that

the UK and the EU’s troubles are symbolic of the decline of the West, weakness that China will seek to exploit. Apparently regarding the EU and UK more as partners than competitors, Chinese analysts have refuted this idea, arguing that a weakened EU or UK is not in China’s interest. However, the same analysts remain divided on whether a weaker EU could prove to be more pro-US and ultimately take a tougher strategic line on China, with EU trade protectionism also emboldened by the absence of the generally pro-trade activism of British MEPs and businesses.

In a talk show broadcast on Phoenix TV on July 2, Cui Hongjian, director of the European studies department of the China Institute of International Studies, said it is not wise to hold the mindset that “the troubles of others are my opportunities.” He explained that the EU is a much better partner for China than the US in terms of both economic development and international cooperation. For example, he said, an EU in crisis would have a negative impact on China’s vision of linking the two markets through Xi Jinping’s ambitious One Belt, One Road initiative, while a weak euro would consolidate the US dollar’s dominance in international finance and thus make the international financial system, which is currently skewed in Washington’s favor, even more unfair.

At the annual China-EU summit that convened in Beijing on July 12, China reiterated its support for European integration, and its expectations for prosperity and stability in both the EU and the UK. Zhou Hong, deputy director of the academic division of international studies of the Chinese Academy of Social Sciences said China is sincere in this policy, and will not downgrade the EU’s significance on China’s foreign agenda. As she told NewsChina on July 17 at the annual World Peace Forum sponsored by Tsinghua University, China values the EU as a counterbalance to US hegemony, and thus pushing the EU toward the US is the last thing that China wants.

Zhou added that she has noticed some positive signs in the post-Brexit EU. On June 25, foreign ministers of the six EU founding member states gathered in Berlin to urge the UK to initiate Article 50 of the Lisbon Treaty, the clause concerning a member state’s departure from the EU, as quickly as possible to allow the remaining members to “move on.” Zhou said the EU sent a clear message that European integration was a project that predated the UK’s joining of the common market, and would thus continue after its departure. In addition, less pro-EU Europeans, even moderate Euroskeptics, have been unnerved by the chorus of praise heaped on the Brexit vote by the continent’s extreme right. Zhou thinks that Brexit has served as a “deterrent” to political moderates who might soften their stance on the EU when faced with a resurgence of right-wing nationalism.

It is true that Brexit also presents opportunities for China to develop closer economic ties with both the UK and the EU. Chinese and EU leaders agreed at the Beijing summit to accelerate negotiations of a bilateral investment deal. Previously, China and Britain agreed to start preparations for free trade agreement (FTA) negotiations during Xi Jinping’s London visit. There is rising consensus among Chinese analysts calling for an acceleration of this process after Brexit, as the UK has traditionally been more desirous of an FTA with China than the EU as a whole. At a July 7 Brexit forum sponsored by Beijing-based think tank Center for China and Globalization, Wang Yiwei, director of the European Union Research Center of Renmin University of China, envisioned a “platinum era” for China-UK relations in the years to come, in other words, something even better than the “golden era” announced by Xi Jinping and former British Prime Minister David Cameron last year.

However, when big business partners like the EU and the UK enter choppy waters, it can reduce the potential net benefit from joint business plans, especially when social and political challenges come alongside economic upheaval. While agreeing that Brexit presents a good chance to upgrade China-UK relations, Zhou Hong is worried about the UK’s future. As she explained to NewsChina, the referendum campaign fully exposed the ideological rifts splintering the UK’s regions and demographics, and repairing the damage will be difficult. She added that, after Brexit, no one can predict with any certainty that France’s hardline, far-right Front National will lose the general election next year. Such uncertainty is never encouraging for investors, another reason why a weakened EU or UK is not in China’s interest.

Cracks along political fault lines continue to appear even in China’s generally friendly relations with the EU. At the China-EU summit held in Beijing July 12, the same day the arbitral panel in The Hague announced its verdict in the South China Sea sovereignty case filed against China by the Philippines, President Xi Jinping reiterated China’s refusal to acknowledge the arbitration. At a press conference the following day, European Council President Donald Tusk called for China to abide by the ruling. Yang Jiemian, senior fellow with the Shanghai Institutes for International Studies, told NewsChina at the World Peace Forum that the EU’s support for the US on such a big issue is not a surprise considering the strategic alliance between the two parties, but added that it also reflected the EU’s instinct to turn to its “big brother” in moments of weakness. In an article for World Affairs magazine published June 24, Zhang Jian, director of European Studies at China Institutes of Contemporary International Relations, said he has observed reduced EU independence from the US in its external policymaking in recent, difficult years. He warned against overestimation of the potential for EU-US divergence.

However, Chinese analysts are generally unconcerned about a full-scale, wholesale strategic and political alignment of the EU with the US. As Zhou said, the EU will strengthen its relations with both the US and China after Brexit. Zhang Jian also noted that the EU currently perceives China as a more equal partner than ever.

Even amid uncertainty, as Britons have discovered since June 23, life will go on. It is now time to take a breath.

Source: China Ministry of Commerce and Society for Worldwide Interbank Financial Telecommunication

Old Version

Old Version