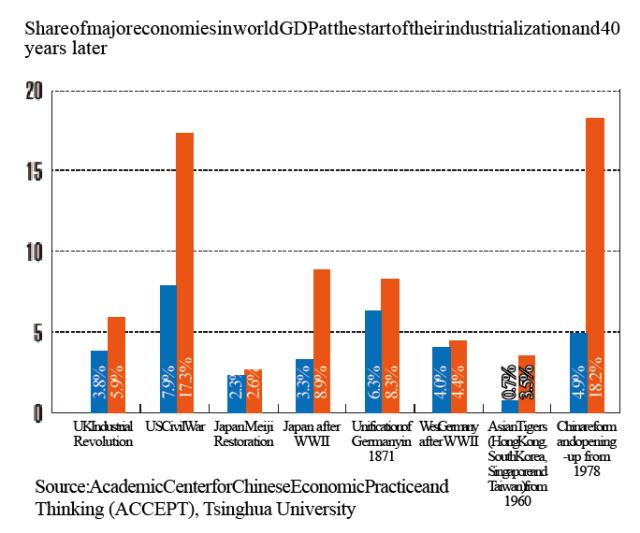

Five lessons from China’s remarkable economic growth over the past 40 years will not only inform decisions for future reform and opening-up in China, but also for other economies, according to a report from the Academic Center for Chinese Economic Practice and Thinking (ACCEPT) at Tsinghua University in Beijing. The research report is arguably the most systematic academic study so far on China’s economic development in the past four decades.

The report, titled “Economic Lessons Learned from China’s Forty Years of Reform and Opening-up,” focuses on how the relationship between the government and the economy has adjusted over the years, as the “most unique aspect of China’s economic growth” is that it began as an economy with “extremely tight governmental and political control.”

The report stresses that reality has always proved much more complicated than orthodox economics, which assumes the government’s role as either irrelevant, or a “benevolent” or “evil” force.

Governments have been important players rather than independent regulators in the growth of other major economies. In China’s case, the government became a “helping hand in facilitating

market growth” over the past 40 years in five ways: providing incentives to local governments, reducing land transfer costs for commercial purposes, maintaining financial stability, learning during the process of opening up and managing the macro-economy.

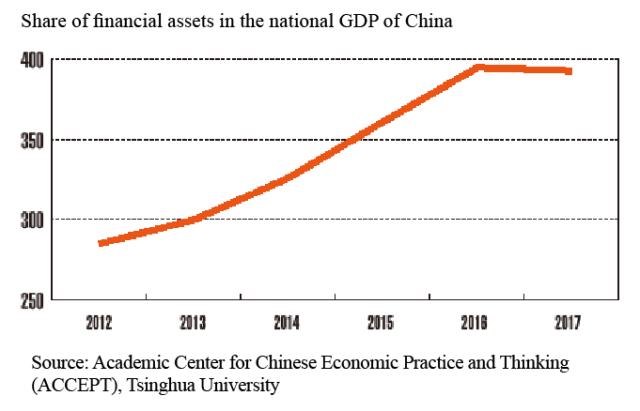

The report also proposes solutions to address the side-effects and difficulties produced by each. Fiscal reform is necessary to put more resources at the local level in order to further spur local governments to boost their economies. Local governments should be encouraged to shift land use from industrial projects to public service and long-term public property projects. The bond market should play a bigger role in financing infrastructure projects for local governments, and authorities must further crack down on irregularities in the stock market. Rising trade tensions with developed economies should not hinder the learning process, and the ways and timing of management tools to smooth economic fluctuations should be more market-oriented.

The Tsinghua team was led by Professor Li Daokui, director of ACCEPT and a prestigious Chinese economist. Li shared his thoughts with NewsChina on the research and findings.

NewsChina: Why is it stressed in the report that the research is purely economic and irrelevant to ideological or geopolitical debates?

Li Daokui: Because the basic rules of economic development would be lost in ideological debates. China’s reform and opening-up started with putting aside debate on whether the endeavor was socialist or capitalist. By avoiding ideological contention, we hoped that China’s experiences of growth would gain international recognition.

Geopolitical debates are mainly about conflicts of interests. The research will be lost in debate between Western economies and China on who has benefited more from China’s growth.

Given this, focusing on economic development makes it possible for us to objectively look into China’s experience in reform and opening-up over the past four decades.

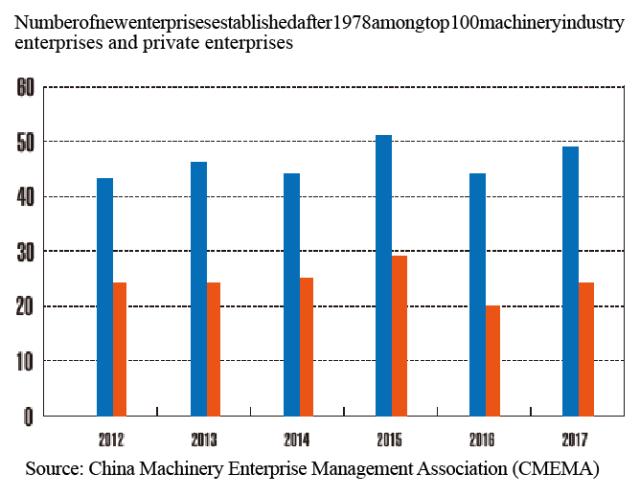

NC: There are two views in international academia on the development of China’s private sector over the past 40 years. One credits it to the support – sometimes even too much support – from local governments. The other argues that China’s private sector grew despite discrimination from local governments. What is your take on these two views?

LD: It’s an important part of China’s experience that local governments were given the right incentives to help local enterprises develop regardless of ownership. Private enterprises have an innate incentive to thrive, but during the past 40 years the government has also helped them, much like coaches and cheerleaders do for athletes.

Local governments have to solve various problems for State-owned enterprises (SOEs), such as compensation for laid-off workers and land transfers. They do not have to do this for private enterprises or foreign-funded enterprises. Some private enterprises fail to follow environmental protection regulations, a misconduct which is rarely committed by foreign-funded enterprises. During our field research, we found that local governments prefer foreign-funded enterprises and private Chinese enterprises over SOEs.

However, private enterprises have been facing discrimination from banks. SOEs normally do not go bankrupt, and even if they do, [the government] would step in to clean up the mess. In contrast, banks find it difficult to deal with liquidation once a private enterprise goes bust.

The way that local Chinese governments help startups and the growth of new enterprises has changed substantially. They no longer control local enterprises like their own subsidiaries. Instead, they have become a shareholder that is much less directly engaged with operations. But their desire for local economic growth remains as strong as ever.

This is not the case in the US or India, where local governments lack motivation for economic development.

NC: But the report does mention that governments of some developed economies, including the US, also give similar support to attract investment, such as tax rebates, land planning, subsidies and even labor recruitment. What is the difference between their support and the support local Chinese governments give to enterprises?

LD: The biggest difference is incentives. Take the US for example. State governments care about employment the most. They do not intervene as long as employment is stable. Local Chinese governments care about tax revenue much more than employment.

In the US, local tax revenues come mainly from the property sector. Although stable employment would boost property prices, its link with tax revenues is indirect. However, a slight business contraction or sales problem would immediately affect tax revenues.

Employment does not change as fast as tax revenues. A company may not hire more employees when the economy is expanding because it’s not sure how long the good times will last. It also won’t cut jobs immediately when the economy is down as it waits for a rebound.

In addition, local US officials pay more attention to elections. Although employment is an important issue for their campaigns, they can also court unemployed groups with commitments to providing better social welfare.

In China, tax revenue stands at the core of economic growth, which is the country’s priority. And tax revenue is closely related to business performance.

As a result, local Chinese officials are busy with helping local enterprises and promoting investment, which is closely related to tax revenue. Western officials are busy with election campaigns, which have less to do with economic growth.

NC: The debate on the relationship between the government and market has long been focused on how big the government role is in the economy. However, your report stresses that the way the government fulfills its role matters much more than how big its role is. Why?

LD: Focusing on the size of the government’s role is too superficial. It is much more important to watch whether the government is doing the right things to boost the growth of the economy and enterprises. The government is made up of people whose behaviors largely depend on what incentives they receive.

Economics, as a subject, should study how incentives drive government officials’ behaviors. This has long been ignored by orthodox economics. China’s experience shows this area is worth further academic research.

If we regard the government only as a regulator, the assumption is that government is neutral and always maximizes the public interest. It is based on the same assumption that referees are neutral and never favor any side in a game. In reality, there are lots of mechanisms to make sure that referees remain neutral.

When there are only restraints on officials in place, this definitely distorts their behavior. For example, they may choose to do nothing to avoid being punished for mistakes. Meanwhile, they hold resources such as land, environmental standards and licenses.

They should be motivated to use these resources properly to boost growth. When they act as regulators, they should also spend time to understand the businesses under their watch. Those who do a better job should be promoted or rewarded with higher salaries. In principle, any participants in the market need incentives. Discipline alone is not enough. The problem in the past few years is that too much discipline has weakened incentives for local Chinese officials.

Our report also recognizes the importance of discipline, especially legal discipline. The legal system has to be independent from efforts to attract investment, and law enforcement has to be consistent across regions.

NC: Your report highlights that China has benefited more from learning than giving full play to comparative advantages during the country’s opening-up. Should China continue to learn technologies and management methods in the new round of opening-up?

LD: We should not only learn technologies, but also any ideas that would advance our development, including rule of law, governance and industrial self-discipline. I want to stress that China began to learn these things on the first day of its opening-up. During trips to Europe in the early years of opening-up, Chinese senior officials told top policymakers they learned from their bank credit system and export and import mechanisms, not technologies.

It’s true that we are facing a more difficult environment for further learning as we are increasingly regarded as a competitor by developed economies. We have to keep calm. We can’t be too proud of our achievements or too upset toward their attitudes and give up learning. We do need to find ways to attract foreign professionals. Although the US has blocked access to some core

cutting-edge technologies, some foreign researchers want to share their knowledge for the sake of human progress and the world. We have to incentivize them to come. In the future, learning will mainly take place through exchanges between experts, not just through purchasing technology, building factories and acquiring enterprises.

We are calling for national treatment for foreigners so they can get permanent residency and good schools for their children. We need an immigration law to make it easier for foreigners to move to China.

NC: Your research aims to sum up a generalized theory which will be recognized and applied internationally. Can other economies learn from the five lessons China learned, according to the report?

LD: Absolutely. First, some economies, such as the US and India, also need to address how to motivate local governments. If federal or central governments share tax revenues with state governments, like the value added tax in India or corporate income tax in the US, local authorities will have a much stronger desire to facilitate the growth of local enterprises and economies. Also, land transfer is the key to development in any economy. It does not mean adopting China’s State ownership system. Transaction costs for land transfers must be reduced. Learning during the opening-up process is crucial. Foreign companies and experts should be welcomed. In China, they even had preferential treatment in the early years of opening-up. Thisreflected China’s willingness to learn from them.

Management of the macro-economy is also necessary. Our report includes a case study of the US airline industry. [The report says the 30 years of overcapacity and excessive competition since the deregulation of the industry since 1980 caused unfair competition, waste of market resources and fluctuations in the wider US economy.]

Finally, there should be financial deepening [diverse financial services accessible to investors and borrowers]. Developing economies must control cross-border capital flows. Domestic inflation and financial crises must be contained so domestic residents want to hold financial assets denominated in their home currencies – in deposits, bonds or stocks. Ruble-denominated assets once accounted for only 30 percent of Russia’s GDP, so it was barely possible for Russian investors to get finance.

All these lessons based on China’s experience are general in nature and relevant beyond China.

Old Version

Old Version