US electric car company Tesla has earned respect as an innovator and disrupter in technology, but it has yet to prove itself a success as a business. It has been dogged by forecasts and rumors of bankruptcy ever since it was founded in 2003 by charismatic but controversial CEO Elon Musk, after years of annual losses. After it disclosed its latest quarterly financial results on August 1 at NASDAQ, the company finally declared that it expected to “become sustainably profitable for the first time” after it reached its mass production goal of 7,000 vehicles per week in the last week of June, but not until after a huge extra push. It plans to increase its capacity further.

Tesla’s confidence in its future is apparently not only built on its Gigafactory 1 near Reno, Nevada, but also on its new Gigafactory 3 in Shanghai. On July 10, Musk signed a memorandum of understanding with the Shanghai municipal government to build Tesla’s first production facility outside the US.

Speculation over Tesla’s intention to build plants in China have been swirling for some time, and the recent deal in Shanghai was made possible by China’s further opening-up of its auto industry which will enable foreign automakers to wholly own their facilities. Tesla’s footprint is expected to reshape China’s fast rising market of new energy smart autos.

Gigafactory 3 will be the largest foreign-funded manufacturing project that Shanghai, always in the vanguard of China’s reform and opening-up process, has ever attracted. While Tesla produces batteries at its Nevada base – the world’s biggest building once it is complete – and assembles vehicles in California, the Shanghai operation will manufacture batteries and vehicles, as well as host research and development facilities. The factory will be an example of what Musk has dubbed the “Dreadnought” – a reference to the amount of robotics and automation his factories have, US business news portal CNBC reported in June. A dreadnought was originally the name of the first type of modern warship built in the early 1900s.

Tesla’s Q2 financial statement says the company is “excited” about the market opportunity in China which is “by far the largest EV [electric vehicle] market in the world” and which offers “exceptionally strong” support for EVs. Since 2015, buyers of new energy vehicles, which includes fully electric and hybrids, can get government subsidies. The policy was adjusted in 2016 and 2018 with higher technical standards. The current adjustment began in June and will be effective till 2020.

According to the China Association of Automobile Manufacturers (CAAM), both production and sales of new energy vehicles in the first half of 2018 almost doubled over the same period of 2017. The market is dominated by EVs, and the government is investing heavily in installing more charging stations. Although most foreign new energy vehicles do not qualify for the subsidies, the fast expanding market and improving infrastructure means more opportunities for all players. To reduce pollution and congestion, some cities in China, including Beijing and Guangzhou, have systems to limit the number of gasoline-fueled vehicles on the roads, but new energy vehicles are exempt.

Tesla outshone Chinese and other international brands of EVs as soon as it entered China in 2014. Like in the US, many Tesla owners in China are rich, famous and want to put forth a public image of being cool and caring about the environment. The first buyers in China included IT leaders like Charles Chao, CEO of Sina, one of China’s leading web portal, Li Xiang, founder of Autohome, an online service platform for auto consumers

and Lei Jun, founder and CEO of smartphone maker Xiaomi.

“Tesla’s Model S and Model X are successful in China’s high-end market. Its more

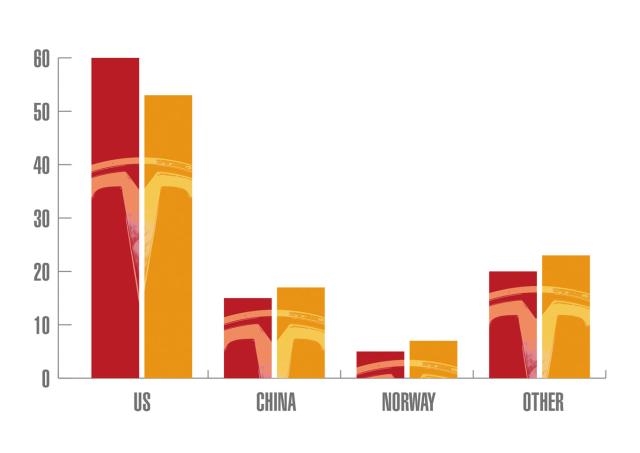

affordable Model 3 is yet to be mass-produced. However, Chinese consumers are ready to accept the price and performance of the Model 3,” said Xu Haidong, assistant to the general secretary of CAAM. According to Tesla’s annual report, sales revenues in China nearly doubled in 2017, generating 17 percent of the company’s total, up from 15 percent in 2016. This was achieved despite the hefty premium Chinese consumers have to pay for a Tesla vehicle – nearly twice as much as a buyer in the US, due to import tariffs and other fees. For example, depending on which make and model, a Tesla Model S or X retails for anywhere between US$130,000-230,000 in China. In the US, a Model S retails for around US$75,000 up to around US$135,000. A Model 3 retails in the US for around US$35,000 – although, CNN reported in May, if you take advantage of all the upgrades, the price will double. And Tesla had yet to start producing the basic model, although it announced it aims to ramp up production to 10,000 units per week in the US in 2019.

The huge market potential and high prices in China gave Tesla huge incentives to base a production facility here, although due to its leading position in the industry, the firm would never be short of offers anywhere in the world. The fight among several US states to host Tesla’s first Gigafactory in 2014 drew a lot of media attention, which analysts pointed out Tesla exploited to get the conditions the potential suitors were willing to offer.

It seemed that Tesla repeated this tactic in China. In May 2014, Musk attended a ribbon cutting ceremony at the launch of a Tesla charging station in Shanghai’s Pudong District, the largest outside the US at the time. Ding Lei, then vice director of Pudong District government, led negotiations with Tesla on possible cooperation. As he told NewsChina, he talked with all Tesla business departments and invited them to build plants in Shanghai. At the end of the year, Tesla informed him that the time was not right to produce vehicles in China. From time to time, reports surfaced that other competitors, including Guangdong Province and Suzhou in Jiangsu Province, also known for their prosperity and business friendly environment, were making overtures to Tesla – reports which the company denied. As yet, there are no details on any incentives Shanghai offered to Tesla. But the metropolis, which already produces Volkswagen and General Motors vehicles, has a fully fledged auto manufacturing supply chain which is probably better than any other city in China.

It may be no coincidence that Tesla finally took the leap to manufacture in China just as trade tensions between China and the US are escalating. China slashed its average tariffs on imports of vehicles and auto parts to 15 and six percent respectively, but hiked duties on autos from the US to 40 percent to retaliate against the tariffs imposed on some Chinese imports to the US. Tesla had to increase its already expensive prices in China. Since there is little sign that trade relations between China and the US will return to business as usual anytime soon, there is more urgency for Tesla to start production in China.

The biggest barrier had always been China’s insistence on 50-50 joint ventures in auto manufacturing, but Tesla refused to countenance such an arrangement. This barrier was removed in April, when China announced this policy was to be lifted on new-energy vehicles and vehicles for special purposes in 2018. The policy will be applied to vehicles for commercial purposes in 2020 and for all other vehicles in 2022.

Tesla estimates it will take three years for the first vehicles to roll off its Shanghai production lines. The planned annual output is 250,000 units initially, and will increase to 500,000 later. But in the first half of 2018, Tesla produced no more than 100,000 vehicles in the US, although it expects to reach 350,000 vehicles per year soon. The plant in Shanghai would clearly strengthen Tesla’s financial position, which has been bedeviled by poor production capacity for years, and lately by fluctuating share prices, following a series of controversial statements and tweets from Elon Musk, who recently tweeted that he was ready to take Tesla private, CNBC reported.

There is no doubt that Tesla will intensify the already fierce competition in China’s new energy smart auto market. Ding thinks Tesla will concentrate on the Model 3 in China, and it will be priced from US$30,000-44,000, a battlefield that both luxury and ordinary brands want. He noted that Chinese competitors had to race both time and Tesla.

“Tesla’s move to manufacture in China brings great pressure to both the domestic and global EV markets,” Xu from CAAM told NewsChina. He explained that domestic brands have yet to catch up with Tesla in terms of gaining consumer recognition. They are doing well in the low-end market, but have yet to catch up in the middle- and high-end market of vehicles costing US$30,000 and above. They will have to compete with Tesla in terms of the best performance that their products can deliver in a consumer friendly way.

Both Xu and Ding agreed that pressure from competition can result in significant progress in the supply chain in the new energy and smart vehicle industry in China. Ding recalled that all parts and components made in China had to be tested in Germany before they could be used on the assembly lines of VW’s joint venture with the Shanghai Automotive Industry Corporation in the late 1980s. But this stringent testing laid a solid foundation for the development of China’s auto parts industry. In the past few years, there has been a surge of new companies investing in new energy and smart autos, started by young tech-savvy people from internet companies – referred to in China as a new force in auto making. Many were inspired by Tesla and Musk. People with rich experience in auto making also sensed the time was right, either working for the new start-ups, or starting their own business.

Before joining the government in 2011, Ding Lei had worked with VW and General Motors in Shanghai for more than 20 years. Realizing there were new opportunities in the vehicle sector, he quit his job as an official to co-found Huaren Technology R&D Co Ltd in 2017. The Shanghai-based company focuses on new energy and smart transportation products, and, Ding said, it was Tesla’s initial refusal of his invitation that fueled his enthusiasm and ambition to make new energy cars. With an international team with rich experience working at leading global auto brands, including Ford, General Motors and Jaguar Land Rover, Ding is confident that he can compete with Tesla in China, and even the world market.

Tesla’s Gigafactory 3 in China is yet to break ground, but the game is already on.

Old Version

Old Version